Last week, PinnacleOne examined the convergence of AI and foreign malign influence efforts on the 2024 year of global elections.

This week, we dive into the new great game emerging in the Middle East over AI, nuclear, and other critical tech.

Please subscribe to read future issues — and forward this newsletter to interested colleagues.

Contact us directly with any comments or questions: [email protected]

Insight Focus | The Digital Great Game in the Middle East – AI, Nuclear Energy, and Geopolitical Competition

The United Arab Emirates (UAE) and Saudi Arabia (KSA) are making bold moves in artificial intelligence (AI) and nuclear energy, using their deep pockets to diversify their economies and increase their geopolitical influence. As Sheikh Tahnoon bin Zayed Al Nahyan and Crown Prince Mohammed bin Salman write eye-popping checks and cut strategic tech deals, the West is taking notice and weighing the risks.

The Gulf States’ Trillion-Dollar Tech Play

The UAE and KSA are going all-in on AI and nuclear power (among other strategic industries like smart cities, synthetic biology, and space). Abu Dhabi’s sovereign wealth funds and state-owned enterprises, armed with over $2 trillion in assets, are hunting for cutting-edge tech, securing increasingly pole position in the funding rounds for emerging unicorns and snapping up large portions of the capital stack in leading western tech start-ups. The Abu Dhabi Investment Authority ($993B), Mubadala ($139B), and G42 ($10B) are leading the pack.

The Emirates recently launched a $100 billion AI-focused investment vehicle called MGX, with Mubadala and G42 as foundational partners. The focus of the fund is AI infrastructure, semiconductors, and AI core tech and applications, and will invest in data centers, fiber connections, chip design and manufacturing, frontier models, applications, data, biotech, and robotics.

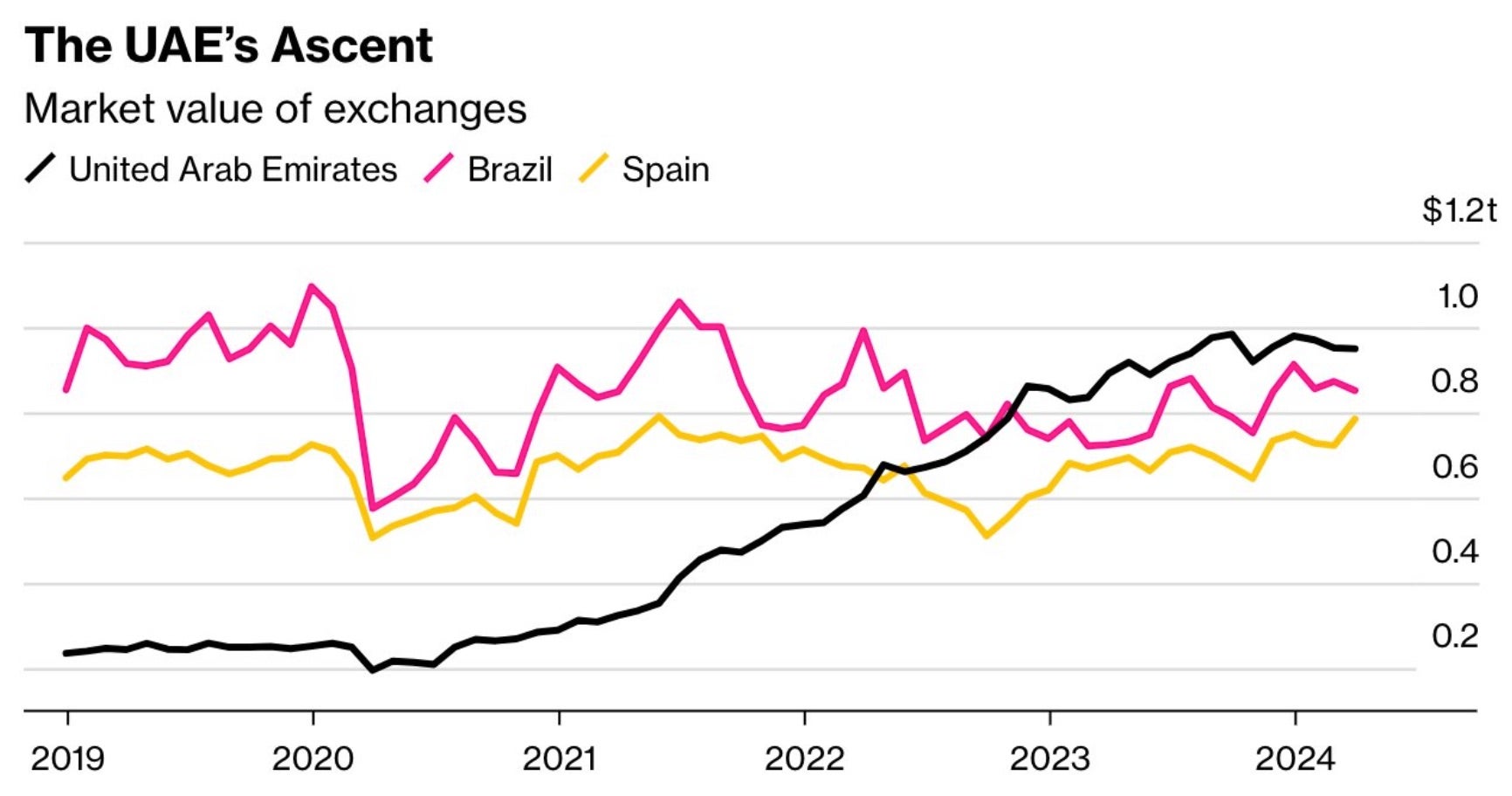

As Bloomberg recently wrote, Sheikh Tahnoon bin Zayed Al Nahyan’s “conglomerate International Holding Co., or IHC, has investments in everything from Rihanna’s lingerie line to Elon Musk’s SpaceX… is up more than 400-fold since 2019…IHC also makes money from trading on the very exchange where it’s listed. It owns the Abu Dhabi stock exchange’s most active broker. Meanwhile, the emirate’s ADQ fund, which Sheikh Tahnoon chairs, oversees the exchange itself…It’s as if one man directed the New York Stock Exchange as well as two-thirds of the companies in the S&P 500 stock index.”

The Barakah nuclear plant, with its four reactors churning out 5,600MW, is set to power 25% of Abu Dhabi. But the UAE isn’t stopping there – it’s eyeing a spot on the global nuclear stage as an investor and developer, eager to partner with both west and east (including Russia) to pursue its strategic ambitions.

Meanwhile, Saudi Arabia’s $620B Public Investment Fund is eyeing a massive $40B AI fund with Silicon Valley heavyweight Andreessen Horowitz. Nuclear energy is also on the table, as the kingdom looks to diversify and counter Iran, as part of the fraught US-brokered diplomatic grand-bargain with Israel (in a tenuous position now given the Gaza conflict).

High-Stakes Partnerships

The Gulf states are forging high-stakes partnerships with Western tech titans and governments. For example, Microsoft’s $1.5B investment in UAE’s G42 comes with strings attached – G42 must use Microsoft’s cloud and play by security rules. However, many of these security arrangements “remain to be worked out, including how to protect AI model weights, which… currently cannot be encrypted while in use… and [the] technical approaches for doing so remain at least a year away.”

Microsoft has “considered several alternative options to protect its technology, including a ‘vault within a vault’ that would involve physically separating parts of data centers where AI chips and model weights are housed and restricting physical access.” It remains to be seen how this arrangement will evolve as lawmakers and Microsoft’s customers continue to ask questions about the security controls.

France is also opening its doors to Emirati nuclear and AI investments, with Finance Minister Bruno le Maire rolling out the red carpet for senior level meetings, “adding that Paris wanted to work closely with Abu Dhabi on semiconductors and computer chip capabilities.”

It should be noted that Mubadala is the majority shareholder in chipmaker GlobalFoundaries, which is building a semiconductor facility in France with STMicroelectronics. France is now looking to jointly invest with the UAE in “cloud computing and data processing and that the strategic partnership would see more scientists and researchers at the Abu Dhabi campus of the Paris Sorbonne.”

For the West, it’s a tempting proposition, getting access to the Gulf’s deep pockets and booming digital markets along with a chance to outmaneuver China. But, the risks are real. Sensitive tech and know-how could slip through the cracks, and the western tech and innovation ecosystem may find itself strategically dependent on investment flows from an authoritarian partner known to be geopolitically promiscuous.

Balancing Act with Beijing

As the U.S. and China jockey for tech supremacy, the Gulf states are walking a tightrope. They’re courting American giants like Microsoft, but also keeping lines open to Beijing. Case in point: Saudi Arabia’s finance minister, Mohammed Al-Jadaan, just wrapped up high-level talks in China, focused on economic collaboration. The meeting, which brought together heavy hitters from the Saudi Central Bank, Capital Market Authority, and National Development Fund, underscores the kingdom’s delicate balancing act.

The West is watching warily. The Microsoft-G42 deal is an explicit attempt to try to box out China, but will it work? The tangled web of interests and alliances in the region makes it an ambiguous and ever shifting affair. As the Gulf states push more “chips” on the geopolitical table, they’re likely to keep playing both sides, seeking to maximize their own interests and extract concessions from western firms looking to do politically favored deals.

The G42-Microsoft Kenya Deal | A Case Study in Digital Sovereignty

The recent $1B investment by G42 and Microsoft in Kenya’s digital infrastructure is a prime example of the tech competition unfolding in the Global South. The deal, which includes a green data center, AI research, skills training, and connectivity investments, is being touted as a milestone in Kenya’s digital transformation.

Beneath the surface though, thorny questions of digital sovereignty and network competition loom large. The involvement of unnamed “UAE ecosystem partners” in Kenya’s fiber cable infrastructure raises eyebrows. Will these be U.S.-aligned firms, cementing Kenya’s place in the Western tech sphere? Or, will Chinese players sneak in, tilting the balance of surveillance and digital economic power?

The answers could have far-reaching implications. As countries like Kenya become battlegrounds in the global AI and digital infrastructure race, their choices about tech partners and standards will shape the geoeconomic and technological map. The G42-Microsoft deal is a test case, a preview of the complex trade-offs and power plays that will define the digital future.

Navigating the AI-Nuclear Nexus

For the West, the Gulf states’ AI and nuclear ambitions are a strategic contest. The prize: a slice of the region’s riches and a tech edge over China. The price: sharing sensitive tech with opaque, autocratic regimes.

To play this game and win, the West needs to strike a delicate balance. Robust safeguards and constant vigilance are a must to keep cutting-edge capabilities in AI, semiconductors, and nuclear tech from falling into the wrong hands. Data access, tech leakage, and research collaboration all need tight controls.

Equally important is a coherent, values-driven strategy. Engaging with the Gulf states can’t just be about chasing short-term profits or geopolitical points. It needs to align with the West’s long-term interests and principles. That means tough conversations about human rights, transparency, and responsible tech stewardship.

Conclusion

The Gulf states are making a trillion-dollar gambit on an AI and nuclear-powered future. For the West, it’s an opportunity and a risk. Navigating this landscape will require a deft touch, balancing short-term gains with long-term strategic imperatives.

As Saudi and Emirati money pours into AI labs, venture ecosystems, and nuclear reactors, and cutting-edge chips and algorithms flow back in return, the stakes couldn’t be higher. The choices made now – in boardrooms from Silicon Valley to Riyadh, in the government corridors from Washington to Abu Dhabi – will shape the global balance of power.

The challenge for the West is to engage with eyes wide open, to seize the moment while safeguarding its crown jewels. It must be a partner to the Gulf states, but also a principled leader, setting the rules of the road for an AI-enabled, nuclear-powered world. Only then can it hope to emerge as a true victor in the age of algorithms and atoms. The new Digital Great Game is on.